In Florida, property tax is handled at the local government level.

Assessed Home Value

Every county in Florida has a property appraiser that assesses the value of each parcel at the beginning of every year. This assessment is used to determine the just value of your home based on current market conditions.

Your home’s just value is usually assessed at 85%-95% of the total value to account for any real estate transaction fees that are unrelated to the true value of the property.

Millage Rates Explained

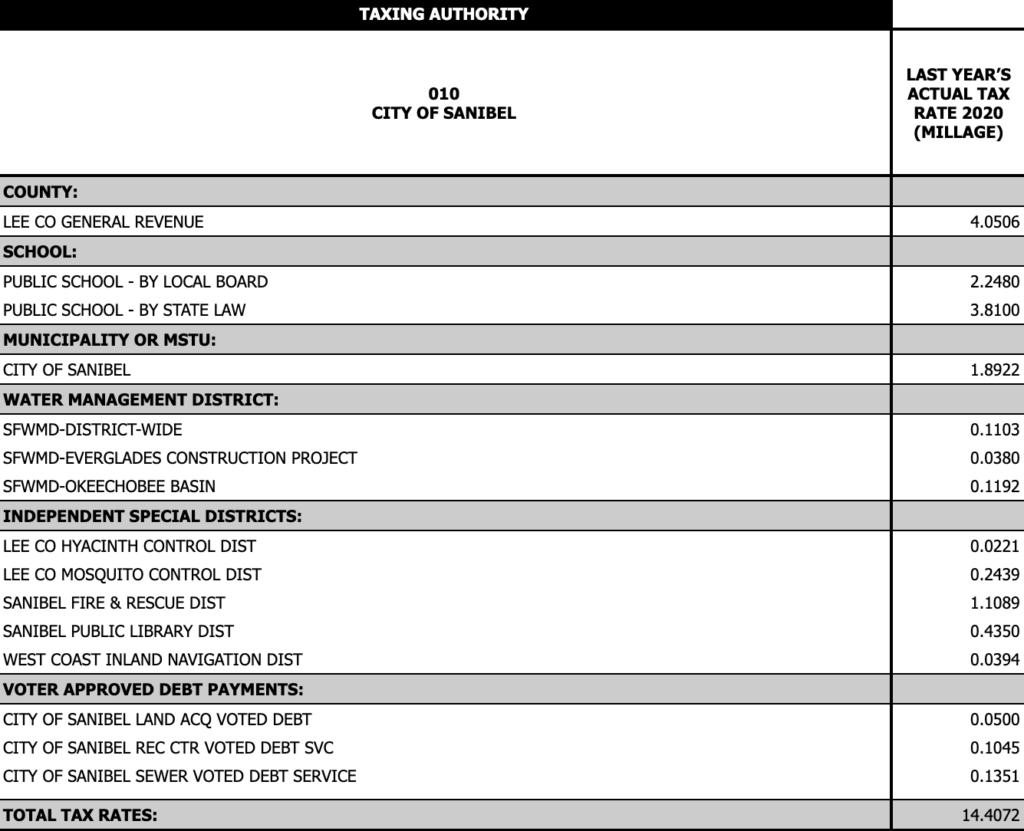

The assessed value of your home is then taxed according to the millage rate determined by your local governments, including counties, cities, school districts, etc. The tax rate, or mil rate will change each year, since it is derived from dividing the total proposed budget of the district by the total taxable value of all real estate in the district.

For homes on Sanibel Island, the total millage rate was 14.4072 in 2020. The proposed tax rate for 2021 is 14.2460. This means you’ll pay about $14 per every $1,000 of the assessed value of your home. Below is a snapshot of the districts that are often included on the TRIM report for homes on Sanibel Island.

What’s A TRIM Report?

Every August, property owners in Lee County receive the TRIM or Truth in Millage report, which outlines exactly what they will owe in taxes pending any budget changes that year. The report breaks down the tax rates for your city and districts and shows the assessed value of your property.

You have the opportunity to file an appeal for the assessed value of your property within 25 days if you feel it is not accurate.

Florida Homestead Exemptions

As we have written about previously, the Florida Homestead Exemption reduces the assessed value of a property up to $25,000 for permanent Florida residents that qualify. An additional $25,000 exemption for properties with a value over $50k is also applied to all district taxes except for the school district millage rate.

That’s a total of about $50,000 worth of exemptions to take advantage of as permanent Florida residents! Click here to read our blog on how to apply for the Florida Homestead Exemption.

There is also the “Save Our Homes” Florida Amendment, which places a 3% cap on the rate at which the assessed value of your home can increase each year for homestead properties. For non-homestead properties, there is a 10% cap.

Lee County Property Appraiser

If you are purchasing a home on Sanibel, your just value and your purchase price should be similar for the first year. We typically suggest budgeting 1% of the purchase price for taxes, which are paid in arrears.

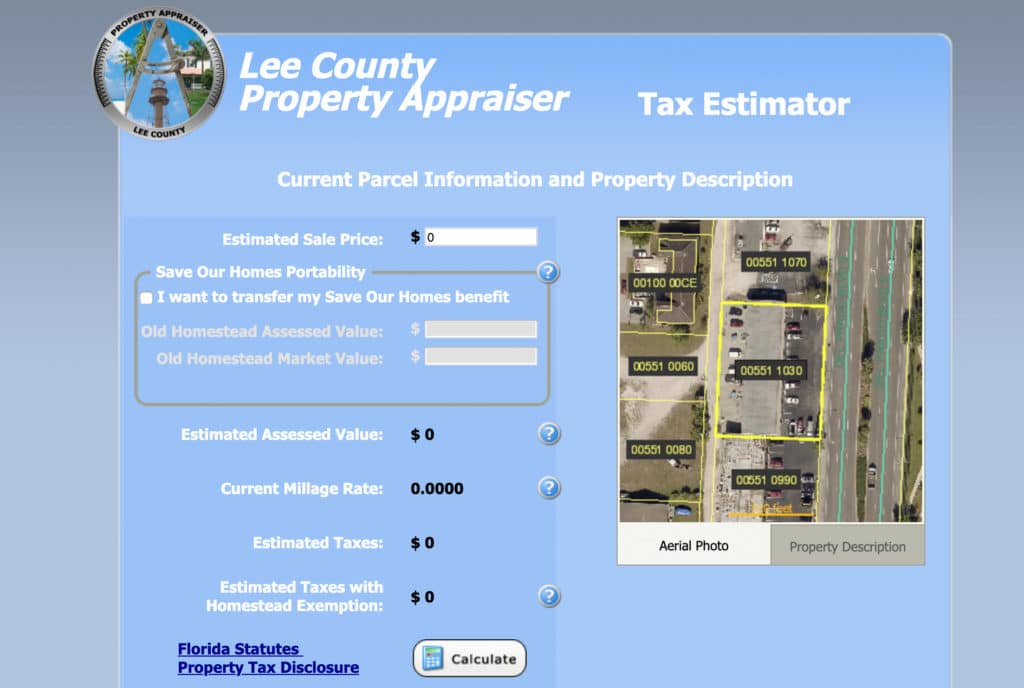

You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing, including parcel details such as square footage, past sales and tax information, and appraisal details.

LEEPA Tax Estimator Tool

The website offers a handy tax estimator tool you can use to plug in the purchase of a property and see the estimated tax based on current mil rates and optional exemptions. We encourage you to use these tools and resources provided by Lee County!

Click here to access the LEEPA Tax Estimator Tool

Contact us for more information on Sanibel/Captiva Real Estate!