Headlines matter. Right now, real estate headlines seem to suggest homes have become unaffordable for most Americans.

That’s not true. Yes, inventory is very low, and demand is very high. The “good ones” are going fast and getting multiple offers. It’s an unusual experience for our Sanibel & Captiva real estate market. But, while the market is competitive, it’s not impossible.

Here’s What You’ll Need…

- Immediate notifications of new listings

- Pre-qualification letter/proof of funds

- Local Realtor® with connections

- Quick decision making and offers

If you’re already working with us, you’re off to a good start! We can help you with all of that and still manage to make the process fun and enjoyable.

Is Real Estate Affordable Right Now?

That’s a valid question, especially after reading the headlines and articles about the current real estate market. What we’ve realized, is that most analysts only look at two of the three elements that make up the affordability equation: price and income.

It’s true that nationwide income stats have not kept up with the average price of houses nationwide. Affordability, however, is about the cost of the home, not just the price. Mortgage rates are the third part of the equation in determining the cost of a home.

Luckily, mortgage rates are still historically low! Honestly, it’s one of the biggest factors of why it’s still a good time to buy a home right now.

Affordability Explained

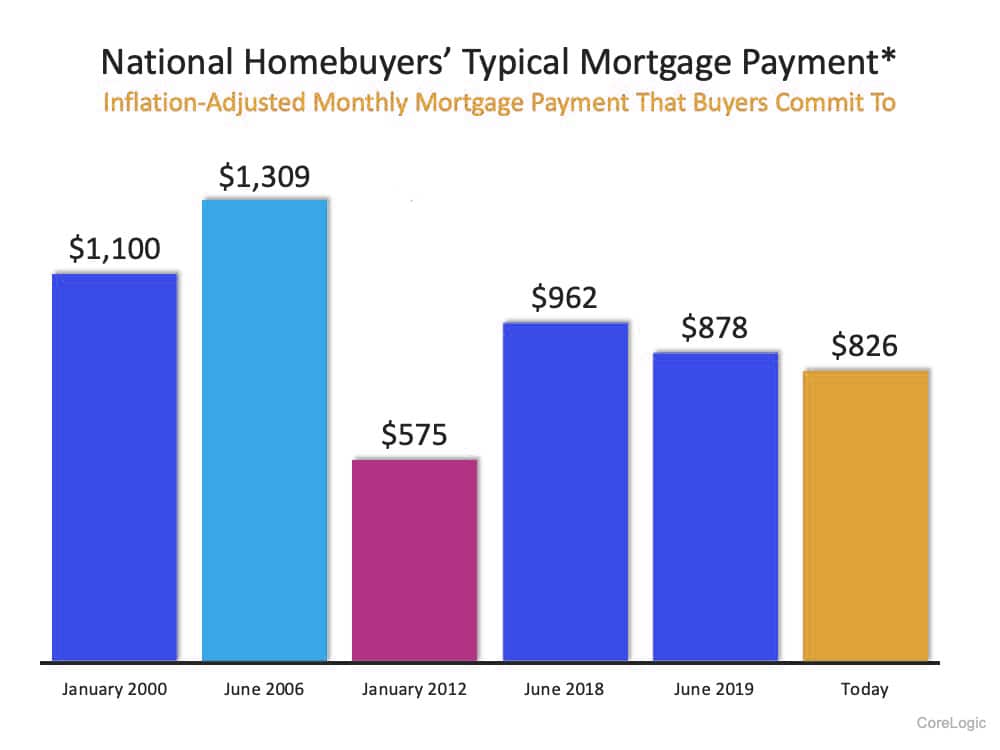

The chart above comes from CoreLogic and serves as an example of how mortgage rates influence the cost of a home. The typical mortgage payment used in this chart represents the inflation-adjusted monthly payment based on the U.S. median sales price. It assumes a 20% down payment, fixed-rate 30-year mortgage, and Freddie Mac’s average monthly interest rate.

Aside from the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

Again, those are nationwide averages provided by Corelogic as an example of affordability. This does not directly reflect what a typical mortgage of a local Sanibel or Captiva home might be.

The Bottom Line

We hope the headlines don’t strike unnecessary fear in those looking to make a real estate purchase this year. We’re happy to chat on the phone with you about your specific situation and provide our honest opinion on the market as it continues to change. It is certainly a crazy busy market right now, but it’s not an impossible one.