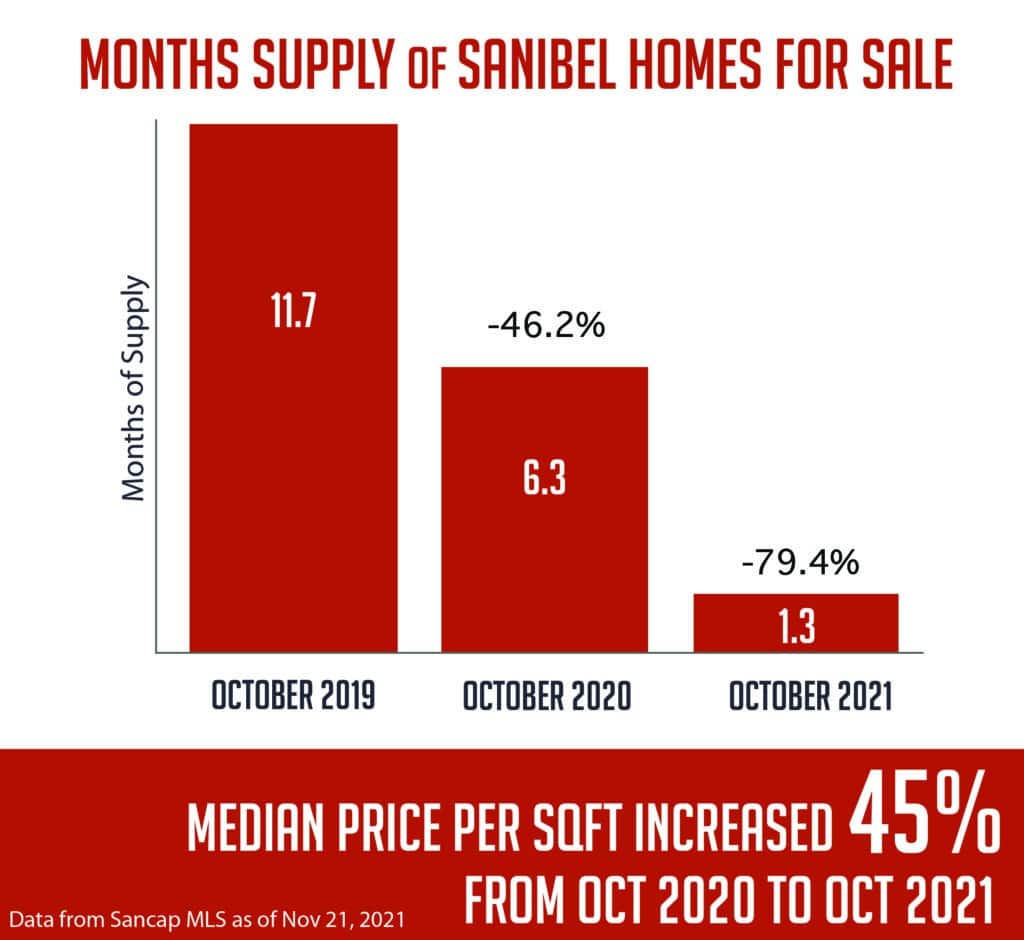

Prices have skyrocketed by more than 40% and inventory has decreased more than 60% from October 2020 to Oct 2021.

It feels a bit crazy and naturally makes all of us a bit concerned about what the future will bring. Are prices going to keep increasing? Why is the market so hot? Is this a bubble like 2007? Should I sell now?

Unfortunately, as much as I want one, I don’t have a magic crystal ball or a working time machine (my flux capacitor is out of plutonium!). Without either of these, I’m not guessing what the future will bring. But I can share what we know from first-hand experience and some important facts about the current market.

Are prices going to keep increasing?

As we all know, prices are determined by supply and demand. The Sanibel housing supply is fixed and many who were thinking of selling in the near future already have sold. Clearly, supply is constrained. So it’s all about demand.

Interest in purchasing on Sanibel is still very high. We have a backlog of buyers we are working with that are waiting for the right property to come to market. Some have been priced out of the market. A few are on the sidelines because they are nervous about a bubble, but not many. In summary, we have many affluent buyers competing over an extremely small supply.

Home Showing Indications

The number of property showings that occur has been a good leading indicator of future sales. The Showing Time Showing Index reports a mild slowdown in showings nationwide, with the exception of the South.

Out-Of-State Buyers

We are also attracting more buyers from across the country. In the past, we’ve seen a large percentage of our buyers coming from the Midwest. In more recent years, more folks from the Northeast have been buying on Sanibel. But recently, we’ve seen a big increase in buyers from out west purchasing on Sanibel.

Factors of Home Price Appreciation

All these factors continue to bode well for continued above-average appreciation. However, this rate of appreciation can’t go on forever. The question is how long will the housing market continue to rapidly appreciate and will there be a drop in values or a return to ‘normal’ appreciation.

Several factors could put downward pressure on the booming housing market. Increased interest rates are a heavily reported concern, but even with some increases, they will remain at historically low rates.

Also, many of our buyers are using profits from equities to fund their purchase. So a correction on the stock market is a risk. But we are also exposed to nationally reported bad news. Remember the algae and water problems of 2018? Also, negative news on the environment, global warming, or sea-level changes could scare off many buyers. A major hurricane is another big concern.

Why is the market so hot?

My best guess is that we are seeing a fundamental shift in how many folks perceive and use housing. Clearly, the pandemic is the catalyst. Since lockdowns, more people see the value in owning a home that they want to spend time in. You can’t control the crazy world, but you can control your space.

Additionally, a great number of well-paid professionals now have the flexibility to work from home. We see this with our buyers. Many are years from retirement but can enjoy a vacation home much more readily than when they only could visit a few weeks a year. Of course, low-interest rates and significant stock market gains have fueled this shift with lots of buying power.

Is this a bubble like 2007?

From our perspective, most definitely not. The 2007 real estate market was fueled in large part by speculation and aggressive lending. We see almost zero speculation. Lending requirements are stiff. Most of our buyers are making cash offers – without any financing contingency. This means most buyers have no question that they qualify for a mortgage or could purchase the property without a mortgage.

Additionally, almost all of our single-family home buyers are purchasing for their own use of the home. Our condo buyers are either purchasing for their use or as a vacation rental (which are in very high demand). I’ve seen some reports in the news about increased foreclosure rates. While these stories may technically be true, foreclosure rates remain extremely low.

Should I sell now?

No one can answer this question but you. If you’ve owned property on Sanibel for even a couple of years, your property is likely worth much more than you paid for it. If you are thinking of moving to a less expensive area, into a retirement-focused community, or downsizing a second home, now may be a great time to take action. However, if you want to stay on island, it is a difficult time to find a new place and in most cases, we recommend finding and purchasing your new home before listing your current one.

We’re happy to discuss the market in more detail with you. Please don’t hesitate to reach out to us at 239-472-1950 or team@mccallionrealty.com.