“Do we need flood insurance?” Good question! If you are financing, yes. If you are not financing, it is up to your discretion.

While I am familiar with insurance from a homeowner and Realtor® perspective, I ALWAYS turn to our local insurance agents for their expertise when my customers have questions about insurance or need coverage.

That’s why I reached out to my long-time business acquaintance and friend, Chris Heidrick of Heidrick & Co. Insurance, for his insight on flood insurance. Read below!

Flood Insurance 101 – by Chris Heidrick

What Does Flood Insurance Cover?

Flood insurance protects you from financial loss caused by inundation (heavy rain) and storm surge (typically resulting from a hurricane). Coverage can be obtained through the National Flood Insurance Program (NFIP) or private insurers.

Flood Zones on Sanibel Island

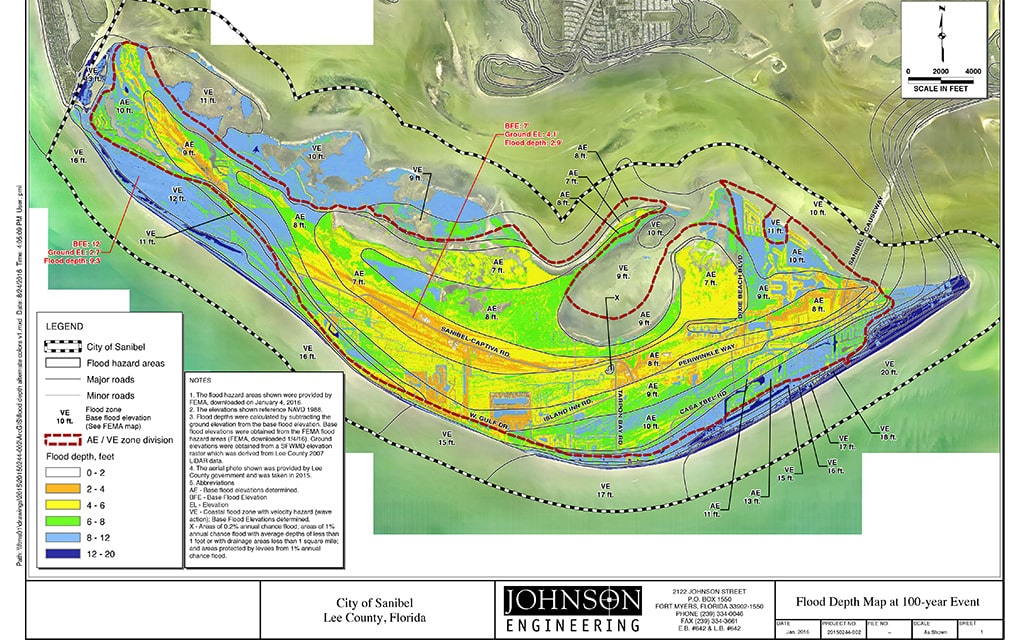

The cost of flood insurance is primarily driven by two factors – flood zone and date of construction. There are two flood zones on Sanibel and Captiva, AE and VE. Both are within the Special Flood Hazard Area (SFHA) and, therefore, lender’s must require you to carry flood insurance if you have a mortgage.

VE is the more expensive of the two flood zones on Sanibel. VE zones are usually found near the Gulf and on the east end of Sanibel Island. However, most properties on island are in the AE flood zone.

The City of Sanibel has a useful resource page with more information about flood zones, elevation certificates, and flood management, which you can access by clicking here.

To view the interactive FEMA Flood Map, click here.

Chris Heidrick is the principal of Heidrick & Co. Insurance on Sanibel. For those who don’t know, the Heidrick office is in the building right next to ours!

About the Author: Chris is the Chair of the Flood Insurance Task Force for the Independent Insurance Agents and Brokers of America (IIABA). He is also the Chair of the Flood Insurance National Committee, a committee of agents that advise FEMA regarding the NFIP. Chris has testified before Congress regarding the National Flood Insurance Program. He and his family have lived on Sanibel for over 12 years, and have been an active members of the island community.